Philippines Could Lose Oil and Gas Block to China

Manila ‘clings to fantasy’ it can exploit site inside China’s nine-dash line

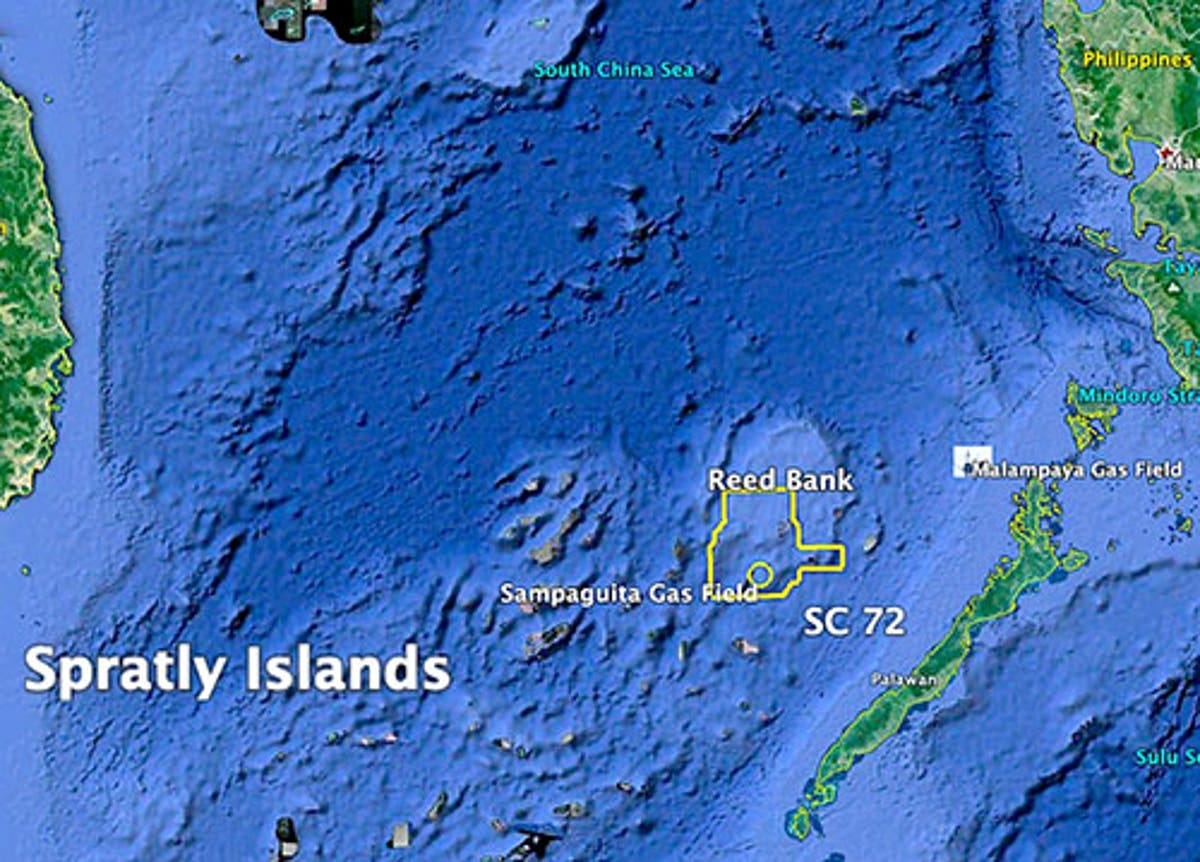

What is really going on between the Philippines and China? Or is Manila, not for the first time, out of the loop and clinging to fantasies that it can exploit its oil and gas in the West Philippine Sea especially on the Reed Bank, well within its EEZ but also within China 9-dash South China Sea claim line?

Earlier this month, the Duterte government anno…

Keep reading with a 7-day free trial

Subscribe to Asia Sentinel to keep reading this post and get 7 days of free access to the full post archives.