Iran Snapback: Systemic Shockwave

UN sanctions snapback ignites regional crisis, tests global powers

The decision by European powers to activate the "snapback" mechanism, automatically reimposing multilateral UN Security Council sanctions on Iran, has pushed the Middle East to the brink of a new crisis.

Tehran's immediate and escalatory response – drafting a bill to withdraw from the Nuclear Non-Proliferation Treaty – signals the gravity of the situation. However, the snapback itself is the primary event, promising to trigger an economic earthquake with regional and global aftershocks that extend far beyond the nuclear file.

This threat over the NPT, while appearing self-destructive, is interpreted by strategic analysts not as an irrational act, but as a calculated gamble to alter the geopolitical chessboard. The maneuver aims to create maximum strategic ambiguity and raise the costs of inaction for the West. The core logic is to shift the dynamic from a one-sided pressure campaign into a two-sided crisis, thereby creating powerful new leverage for any future negotiations. It is a high-risk doctrine of ‘escalation for de-escalation,’ designed to force a diplomatic reset by making the status quo untenable for all parties involved.

Unlike the unilateral US sanctions, to which Iran's economy has adapted with various countermeasures, Security Council sanctions carry the weight of international law and a far broader enforcement mandate, posing a significantly more devastating threat. While Iran is the epicenter of this earthquake, a deeper analysis reveals a complex picture of a systemic crisis impacting its trading partners and regional powers.

Iran, ground zero

The return of the UN sanctions confronts Iran's already fragile economy with a structural shock reminiscent of the country’s 2012 experience when similar sanctions caused the nation's GDP to plummet by a staggering 6.8 percent. Severe financial restrictions will disrupt Iran's trade transactions, even with neighboring countries.

Oil and petrochemical exports are likely to collapse, driven by prohibitive insurance and shipping costs and risks, drastically reducing the country's foreign currency income, with historical precedents suggesting a potential drop of over 50 percent. The psychological shock of returning international sanctions, coupled with dwindling foreign reserves, will intensify inflationary expectations, leading to a freefall of the Iranian rial.

Economic models project that such a scenario would push the inflation rate above 75 percent and the exchange rate beyond 135,000 tomans per US dollar according to an Iran Chamber of Commerce report published earlier this year. The inability to import necessary equipment and technology will bring industrial and infrastructure projects to a standstill, pushing the unemployment rate above 14 percent.

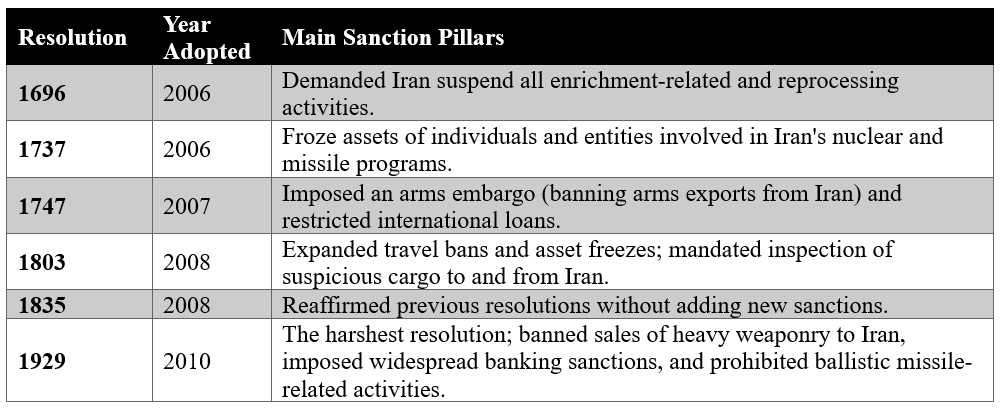

The snapback mechanism means the revival of six main UN sanction resolutions imposed on Iran before the Joint Comprehensive Plan of Action agreed in Vienna in 2016 with the permanent members of the Security Council. These resolutions entail a crippling set of restrictions on nuclear, military, and financial activities, summarized below:

The region on the frontline

Iran's neighbors, particularly Iraq, the UAE, Turkey, and Afghanistan, will be the first to feel the economic aftershocks with disruption of bilateral trade: The return of sanctions makes official trade with Iran exceedingly risky. Regional companies and banks collaborating with Iran would be exposed to secondary sanctions leading to increased regional investment risk. Heightened geopolitical tensions can be expected to elevate the overall risk profile of the Middle East. Insurance premiums for shipping in the Persian Gulf will rise, making foreign investors more cautious.

The humanitarian and security spillover is the most dangerous and unpredictable consequence. A total economic collapse in Iran would not remain a domestic issue and would quickly morph into a regional crisis, possibly triggering severe deterioration of economic and social conditions that could trigger an exodus of hundreds of thousands, or even millions, of people toward the borders of Turkey, Iraq, Azerbaijan, and Pakistan, placing unbearable pressure on the host countries' resources and security.

A weakened central government in Tehran could lead to power vacuums in unstable border regions, creating fertile ground for the resurgence of extremist groups and transnational criminal organizations—a direct threat to the entire region.

Strategic Test for China and Russia

Although China and Russia, as permanent members of the Security Council, oppose the activation of the snapback mechanism, it is designed to bypass their veto power. This eventuality challenges the economic and strategic interests of both nations.

China is Iran's largest trading partner and the primary buyer of its oil. The return of UN sanctions complicates the situation for Beijing. While UN sanctions don’t directly target the oil trade, by targeting financial, insurance, and shipping entities, they significantly raise the cost and risk of purchasing oil from Iran for Chinese refineries.

The complete economic isolation of Iran transforms the country from a potential partner into a black hole on China's strategic Belt and Road Initiative map, posing a serious obstacle to Beijing's long-term plans.

For Moscow, the consequences of the snapback are more geopolitical than economic, given the limited bilateral trade volume. Russia views Iran as a key ally in countering Western influence in the Middle East. An isolated Iran, embroiled in a deep economic crisis, would be a much weaker partner for advancing Moscow's regional objectives. Although Russia sees the activation of the snapback as a symbol of Western unilateralism and an undermining of international institutions and Moscow will oppose it, the Kremlin has limited tools to prevent its enforcement by international banks and corporations.

Beyond national crisis, systemic global failure

The notion that activating the snapback mechanism is merely a tool to isolate Iran is a dangerous oversimplification. This is not a zero-sum game. In reality, the snapback triggers a "negative-sum game" in which all major players lose, albeit to varying degrees.

The economic collapse of a nation of 80 million people in a sensitive geostrategic location would create an economic and security black hole in the heart of the Middle East. This vacuum would export instability to its neighbors. The costs of containing the resulting humanitarian and security crises would quickly fall upon the entire region and the international community.

For global powers like China and Russia, the consequences are more than a temporary disruption. For Beijing, it represents a strategic setback to its vision of a multipolar world order. For Moscow, the severe weakening of a regional ally alters the balance of power in the Middle East to the detriment of its strategic interests.