Epstein’s Asia Concerns Ensnared Malaysia’s Anwar?

Disgraced financier’s interests ranged across Asia

By: John Berthelsen and Toh Han Shih

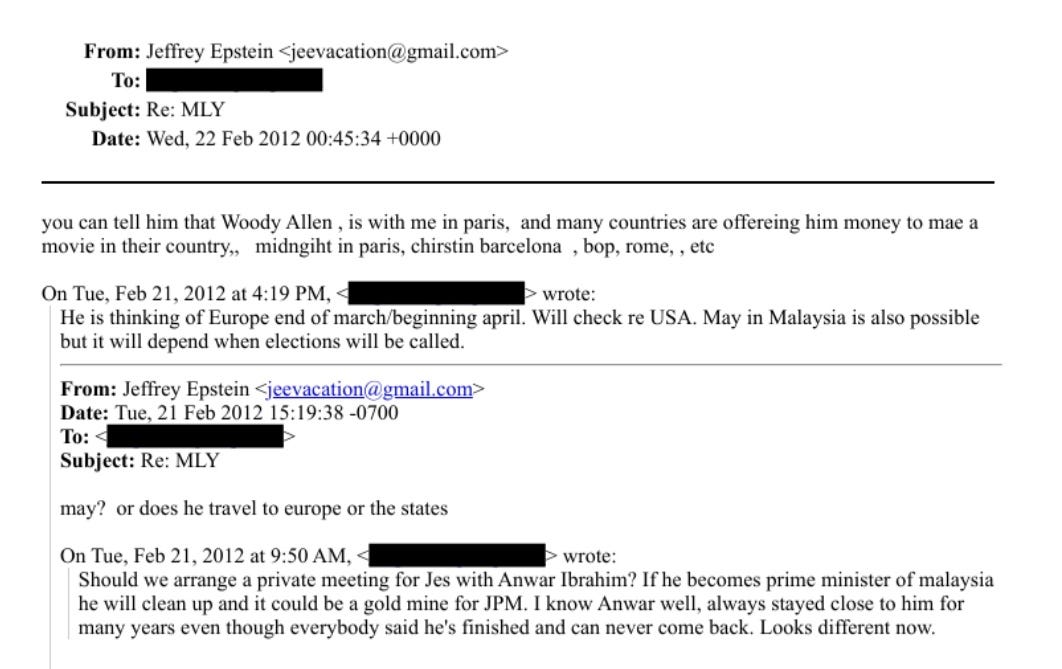

Jeffrey Epstein, the late human trafficker and sex offender at the epicenter of a gigantic scandal reaching into the very top of US and British politics and royalty, suggested in 2012 that if Anwar Ibrahim, then newly acquitted of sodomy charges, were to become Malaysian prime minister, Anwar would “clean up” and JP Morgan Chase, the US banking giant, could profit. Epstein said he had “always stayed close” to Anwar, which the Malaysian premier immediately denied.

The Anwar revelations were among more than 3 million pages released on January 30 by the US Justice Department concerning Epstein, a former friend of Presidents Bill Clinton and Donald Trump as well as former Prince Andrew, who in late 2025 was stripped of his titles and was henceforth known as Andrew Mountbatten-Windsor. Epstein appears to have participated in an array of other business deals related to China and Hong Kong, providing business intelligence and advice, with mentions of former UK trade minister Peter Mandelson, Hong Kong tycoon Li Ka-shing, Li’s business partner Solina Chau, and Chinese banks.

Epstein was arrested and charged with trafficking underage girls for sex in July 2019. Two months later, he was found dead at age 66 in his prison cell in the US. Authorities said he had committed suicide.

The latest trove of emails was released after weeks of delay by US officials, raising widespread criticism that the delay was at the behest of Donald Trump, who had been a friend years before the two fell out.

Anwar an Epstein friend?

The one concerning Anwar was apparently addressed to a redacted individual but mentioned an unknown Hong Kong-based official with the initials DS at Witan Group Hong Kong, a venture capital investor focused on technology, healthcare, and retail, and suggested arranging a meeting with former senior US banker James Edward “Jes” Staley, a close Epstein confederate who spent 34 years at JP Morgan’s investment bank before moving on to other banking firms, ending up as CEO of the British bank Barclays.

In his 2012 email, Epstein wrote: “Should we arrange a meeting for Jes with Anwar Ibrahim? If he becomes prime minister of Malaysia, he will clean up and it could be a gold mine for JPM,” an apparent reference to JP Morgan Chase. “I know Anwar well, always stayed close to him for many years even though everybody says he is finished and can never come back. Looks different now.”

There are no emails from Anwar in the released documents. He issued an immediate denial saying, “Only today did I find out that an outside party wanted to meet me, even quoting my name in an email linked to the Epstein case. The contents of the email are from more than a decade ago, and I have absolutely no connection whatsoever to any of the parties exchanging those emails, especially Epstein.”

“Alright, I’m off to continue sightseeing in Johor Bahru,” he said.

Although Anwar was acquitted in 2012 of abnormal sex charges brought in 2008, in 2014 the Court of Appeal overturned the acquittal and he was sentenced to five years imprisonment in an affair derided by human rights organizations across the globe as a politically motivated attempt to destroy his political career. Against all odds, he resurrected his political career and became prime minister in 2022.

It’s uncertain how much damage the revelation will do. The Epstein reference is more than a decade old and there is no evidence JP Morgan has had any outsize dealings with the Malaysian government. In any case, it would be 10 years after the Epstein email before Anwar rose to power. By that time, Staley had moved on to Barclays, where he was forced to step down in 2021 amid a regulatory probe into whether he mischaracterized his relationship with Epstein.

Other Asian contacts

Among other revelations, a January 20, 2011 email from Epstein asked the former EU Commissioner Peter Mandelson why he was inquiring about a man named Admal Khan. Mandelson told Epstein, “Cos he is trying to recruit me to Li Ka Shing deal. Know him?” Epstein subsequently replied, “He is also trying to involve sultan, no one knows him, I fear he is a fake.”

In September 2025, UK Prime Minister Keir Starmer sacked Mandelson as ambassador to the US for the latter’s association with Epstein. In a statement to BBC Newsnight on January 12, Mandelson said, “I was wrong to believe him (Epstein) following his conviction and to continue my association with him afterwards. I apologise unequivocally for doing so to the women and girls who suffered.”

In an email on July 17, 2012, Boris Nikolic, a biotechnology investor and former technology adviser to Microsoft founder Bill Gates, asked Epstein whether it was okay to meet with Ian Osborne, a former director of the UK-based Hedosophia Services, which, with backing from vehicles linked to Bloomberg and Li Ka-shing, had invested in technology companies including the Chinese e-commerce giant Alibaba, reported the Financial Times.

“Of course if I meet him I will be super discreet and careful,” Nikolic’s email to Epstein added.

Nikolic’s email to Epstein included an earlier one from Osborne to Nikolic, which said, “In addition to you and I have an overdue-but-most-welcome chance to talk properly, I also want to introduce you if possible to Solina Chau, who is the life partner of Li Ka Shing - also the chairman of his foundation and she heads all the foundation’s investments. (They were the co-investor with Microsoft in Facebook back in 2007). While she knows Bill (possibly Bill Gates), I mentioned you and she is interested to have coffee. She is in London from July 24th to 28th.”

On October 22, 2013, Nikolic emailed Epstein a draft description of the Life Sciences & Technology Fund. According to the draft, the fund, to be based in San Francisco, had a target of US$250 million to US$400 million of committed capital for investment in “the intersection of life science and digital technology.” Nikolic asked Epstein to discuss this fund. Nikolic told Epstein he had already discussed this fund with Bill Gates, Elon Musk and Elon’s brother Kimbal. Nikolic added that in November 2013, he intended to discuss this fund with Li Ka-shing and Solina Chau as well as George Soros and his son Jonathan Soros.

In an email on January 5, 2012, Osborne asked Epstein to look at a document and added, “We are taking your advice to send this to Li Ka Shing lawyers at the same time as answers to questions which are not covered in this Agreement. If your comments and ours can be incorporated swiftly, ideall(y) this will be sent out by close of business in London tomorrow.”

The above email contained a confidential email from Slaughter and May, a UK law firm.

The email was a follow-up from one on January 4, 2012 where Osborne told Epstein, “Solina gave me her personal feedback on the 16th but she did not instruct lawyers until last week — and their comments did not arrive until this morning. I’m not dragging my feet on this - quite the opposite - I’ve asked Solina to fast track this but I have limited control over her process. Whilst we could have gone ahead without her and Li Ka Shing, I prefer to include them. It underlines the close relationship I have with them but they are also one of the most credible investors in this sector worldwide.”

Former Prince Andrew’s associate proposed deals to Epstein

Andrew’s downfall affected a business networking company, Pitch@Palace, which he founded in 2014. The UK company was closed on February 3 and a director of the firm, David Stern, resigned on December 9, 2019, according to UK corporate records. Stern pitched China-related deals to Epstein, the Epstein files reveal.

According to his biography which Stern emailed Epstein, Stern founded in 2006 Asia Gateway China, a Beijing-based healthcare IT firm. In 2002, Stern founded Asia Gateway Limited, a China-focused advisory with offices in Beijing and London.

In an email on July 14, 2015, Stern told Epstein they could “have a look if there is something to be done” regarding China Construction America, a US subsidiary of a large Chinese state-owned enterprise (SOE), China State Construction Engineering Corporation.

In an email on September 25, 2012, Stern forwarded to Epstein a news report that Temasek, a Singapore sovereign wealth fund, had sounded out potential buyers for its 18 percent stake in Standard Chartered, estimated to be worth £6 billion. Stern asked Epstein, “StanChart stake? Had dinner with Chairman of StanChart with PA and can see him anytime. It says JPM (JP Morgan) is interested. Good bank for China/Asia and Africa?”

In an email on November 21, 2011, Stern told Epstein, “For the African investment vehicle we can be the bridge between the Chinese and African side: both get what they want with maximum protection/distance (ie no direct Chinese involvement) through us as intermediary. It can be a deal machine once Chinese capital gets involved. It would fit in perfectly with the other plan of managing Chinese wealth.”

In an email on August 18, 2011, Stern asked Epstein whether they could “go in this direction” involving a “discreet investment firm” based in London, Beijing and New York, with access to capital of a minimum of US$1 billion or JP Morgan name or “ideally both”. Stern told Epstein, “You are invisible (only private billionaires get eventually access to you). I run it to the outside. All (execution) work done by JPM. Deals globally where Chinese want to be involved but need discreet help.”

This investment firm would involve Chinese SOEs and private wealth, focusing on investment outside China, Stern suggested to Epstein.

In an email on March 23, 2011, Stern asked Epstein, “Do you want to send the idea (if you like it) of investing in [London’s secondary airport] Stansted Airport to the Chinese guy that came to see you (Beijing Capital airport)? Good way to test him. Could be an interesting deal.”

An email on May 23, 2011 from Desmond Shum to Epstein said action was needed on a meeting on May 19, 2011 involving “senior executives of two major Chinese banks based in Shanghai, to discuss the regulatory requirements, the banks’ current operation and service capability of offshore banking”.

Shum, a Hong Kong businessman living in the UK, wrote a book, “Red Roulette,” recounting business deals between his former wife Whitney Duan Weihong and Zhang Beili, the wife of former Chinese Prime Minister Wen Jiabao.

An email on July 21, 2011 to Epstein from a person whose name was redacted cited a news report that the J. Rothschild Crest Partners fund hoped to raise US$750 million from Chinese investors by the end of 2011. In that email, that person told Epstein, “This topic keeps moving fast, its a massive opportunity. I will keep low profile/no action as instructed until you give me the go-ahead, but time is critical since Chinese government changes in Spring 2012.”

Toh Han Shih is a Singaporean writer in Hong Kong and a regular contributor to Asia Sentinel.

Wow, the plot thickens! This Epstein sure cast a wide net. And for a billionaire, he couldn't spell?! Maybe spellcheck was beyond him?